Article 10 of Act No. 173-2020 (“Act 173-2020”) amended the provisions of Section 4041.02(b) of the Puerto Rico Internal Revenue Code of 2011, as amended (“Code”), in order to change the due date of the Tax on Imports Monthly Return (Form AS 2915.1D) (“Imports Return”), effective for the return corresponding to the month of October 2021. Pursuant to the provisions of said Section, the new due date to file the Imports Return is the twentieth (20th) day of the month following the month in which the transaction subject to the tax takes place, the same due date established by the Code to file the Sales and Use Tax Monthly Return (Form AS 2915.1) (“SUT Return”).

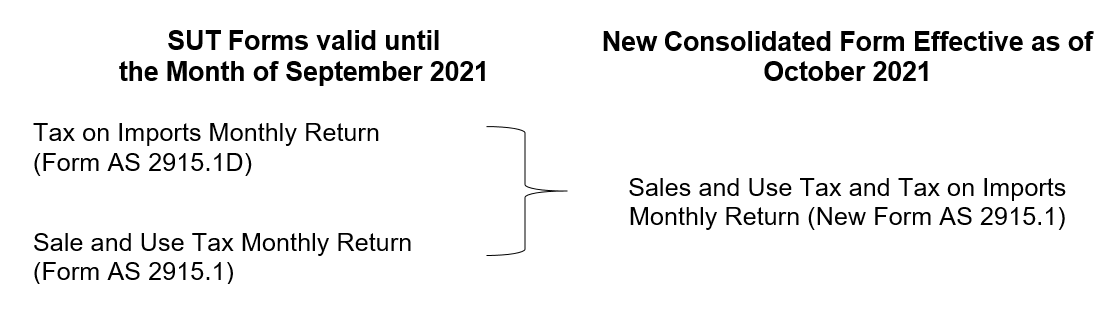

Based on the above, as a way of simplifying the process of filing the Imports Return and the SUT Return, the Department of the Treasury ("Department") issues this Informative Bulletin with the purpose of notifying the release of a new Sales and Use Tax and Tax on Imports Monthly Return (Form AS 2915.1) ("New SUT Monthly Return"), which consolidates both returns. As such, for the return corresponding to the month of October 2021, which is due on Monday, November 22, 2021, merchants will only have to file the New Monthly SUT Return, instead of both the Imports Return and the SUT Return.

The New SUT Monthly Return is available on our website, www.hacienda.pr.gov, under the Forms, Returns and Schedules section. However, the published copy is exclusively for informative purposes, given that it can only be filed electronically through the Internal Revenue Integrated System ("SURI", for its Spanish acronym), following the same procedure used to file the SUT Return.

In addition, the Departament also notifies that, as part of the filing process of the New SUT Monthly Return through SURI, merchants must restore the portion of the bond being used in the Declarations of Imports (Form AS 2970.1) filed during the period to complete the filing of the New SUT Monthly Return. Nevertheless, any additional payment that may be reflected in the New SUT Monthly Return not related to the restitution of the bond, must be paid through SURI after such form is filed, but before the due date established under the Code to avoid the imposition of any applicable surcharges, penalties and interests.

Finally, the Department urges those merchants who claim the Credit for Sales of Merchant’s Property (Section 4050.02 of the Code) or the Credit for Bad Debts (Section 4050.03 of the Code) in the New Monthly SUT Return, to maintain any and all supporting evidence in their records, since it could be subsequently requested as a condition to grant such credits.

The provisions of this Informative Bulletin are effectively immediately.

For additional information regarding the provisions of this Informative Bulletin, you may direct a message through your SURI account or through the SURI Assistance link that is available on the SURI home page without the need to register or log in.

Cordially,

Ángel L. Pantoja-Rodríguez

Deputy Secretary